When Applying for Franchise Financing, a Borrower Should Consider These Important Items in a Franchise Disclosure Document (FDD)

Does a FDD affect the financeability of a franchise?

Lenders who participate in offering government-backed loans (SBA loans) to borrowers, pay close attention to several sections of the FDD (Items 2, 7, 15, 19 & 20) when considering a loan application. Whether the business is a start up location, expansion, or acquisition there are particular item numbers of the FDD that are carefully reviewed. The following is a discussion of the items numbers that are important and the reasons why lenders pay close attention to these sections. Please note that the discussion below is not necessarily organized in any order of importance. The discussion is organized in numerical order, pointing out what to look for and why.

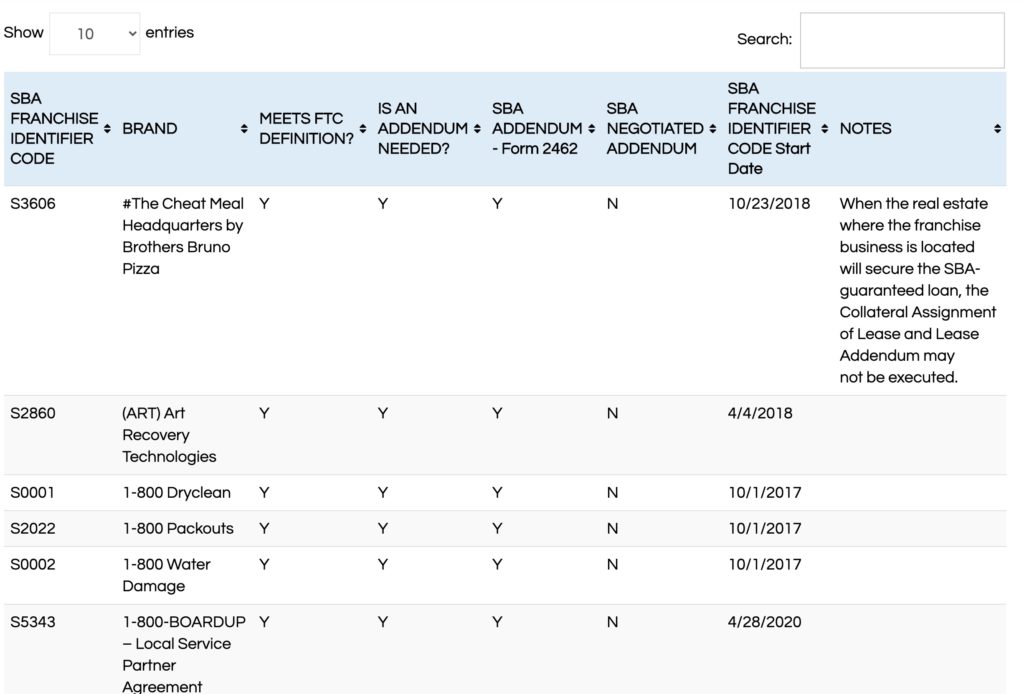

SBA Approved Franchises

Publicly Accessible Databases of Franchise FDDs

Most FDDs are kept private and confidential until you as a prospective franchisee express a serious interest in the franchise brand. You may even be required to sign a non-disclosure document prior to receiving their FDD. However, there are a number of states that require the franchise to register with them and make their FDD publicly available. If you would like to search for and view franchise FDDs for your own research, the following sites are excellent resources…

California Department of Business Oversight – Franchise Search

Wisconsin Department of Financial Institutions – Franchise Search

Key Commercial Capital Franchise FDD Directory

FDD Item 2: Business Experience

It is important to understand who is in charge of running the company. Section two of the FDD should summarize background information about the individuals who are the founders and/or managers of the franchise. Most lenders want to see a description of education, past experience, work history and expertise offered by those who oversee the management of the company and its franchisees. If this section is blank, devoid of detail or does not list names, history or background of those in charge it will send up a “red flag”. There should be some discussion about who handles the particular tasks of management, sales, technology, marketing and training. One individual cannot possibly handle all responsibilities. There should be a team of people and at least a basic description of what role each person plays and some detail about his or her education and past experience.

Lenders will consider the expertise of those at the top when thinking about the level of support offered to the franchisees. The potential success of individual franchisees (territory owners) can be partially dependent on the expertise of those running the company and the level of control and support they give to each territory owner. Lenders may not be comfortable lending to an individual franchise territory owner if they sense a lack of organization or experience by those in top management positions.

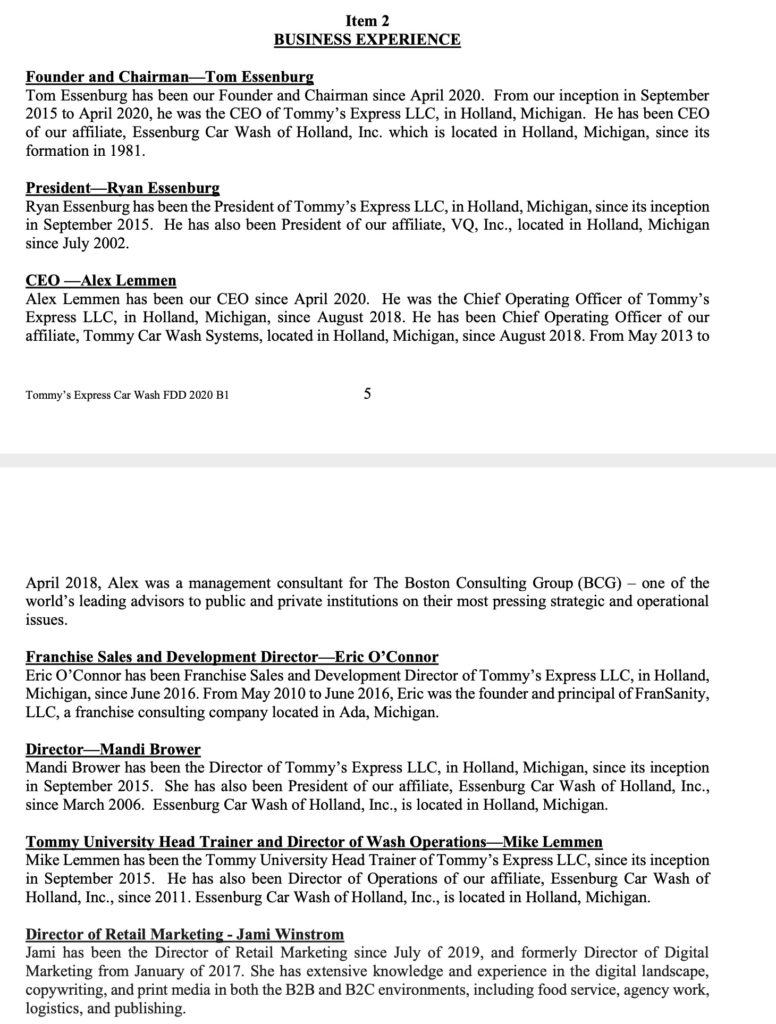

FDD Item 7: Estimated Initial Investment

This section of an FDD outlines different categories of expenditures a franchisee will be expected to pay at different times of the ramp up phase of the business. It will describe the type of expenditure, an estimated low to high dollar amount range, the method of payment, when it will be due and to whom the payment will be made. When a franchise is new it is quite common to underestimate this range of expenditures. It usually takes time and experience for a franchisor to really nail down the right dollar amount range of investment that a franchisee should expect. There are a number of things that also affect changes in the range of investment. Equipment upgrades over time affect costs. Contractors in different areas and states charge different prices for construction. Sometimes the low to high dollar amount range is quite large.

It is important for a lender to understand that an applicant has done his or her due diligence in researching these expenditures when creating a project cost breakdown. If the business will require commercial space, the borrower should be calling commercial real estate agents or brokers to determine the average costs of space in the particular area where the business might be located. It is also a good idea for the applicant to go to the area to view a few spaces to get an idea of what the space looks like, what other businesses are located nearby, the amount of vehicle and/or foot traffic passing by, the space for parking and the visibility of signage. Location can be a very important part of the success or struggle for a new business.

General Contractors should be contacted to share some idea of what an estimated build out would be. Sometimes these figures are based on a square footage price, but are dependent upon the complexity of the project. Loan applicants should familiarize themselves with the regional averages for lease space, construction and build out and the costs of permits. The franchise usually provides guidance on architectural plans, equipment pricing from suppliers and cost ranges for insurance. All of these things are important when preparing an application for a loan. Lenders will want to know that the applicant has put thought and research into the summary of costs.

Borrowers should be creating a project cost breakdown that is within the range that is shown in item 7 of the FDD. If the total cost and itemization of expenditures is different from what is the range on the FDD there will need to be a reasonable explanation provided as to why the project cost estimate is higher or lower than the FDD, Item 7 range. Sometimes simply the location can be a reason why the project will be more than what the FDD, Item 7 estimates. Obviously lease space and construction might cost more in a large metropolis than in a small town. As long as the borrower is prepared and can provide a good explanation the lender should be somewhat satisfied with the estimate.

Project cost estimates can change as time progresses, especially when construction and build-out is required. It is a good idea to estimate a little higher just in case quotes come back higher than expected and to plan for a cushion. It is always an easier task for bank underwriters to get an approval for a higher amount and to decrease the loan amount at the end of the rounds of funding than to do the opposite. It is tough to get an approval for a certain amount and then have to go back to underwriting to increase the loan amount late in the game.

Working capital is also something that new business owners tend to underestimate when calculating the amount that will be necessary for this expenditure category. It is smart to plan ahead for extra funds that might be needed. An extra employee might need to be hired and trained. A special advertising or marketing opportunity might pop up. A piece of equipment might need to be replaced or repaired. There are an endless number of small things that can add up to large amounts unexpectedly. The business should plan ahead to have extra funds in the account to cover unexpected costs, especially while the business is in its ramp up stage. If all is well and the business revenue is steady extra payments into the loan principal are always acceptable. Most SBA loans have no pre-payment penalty. It is better to have extra funds than to be strapped for cash if a challenge arises.

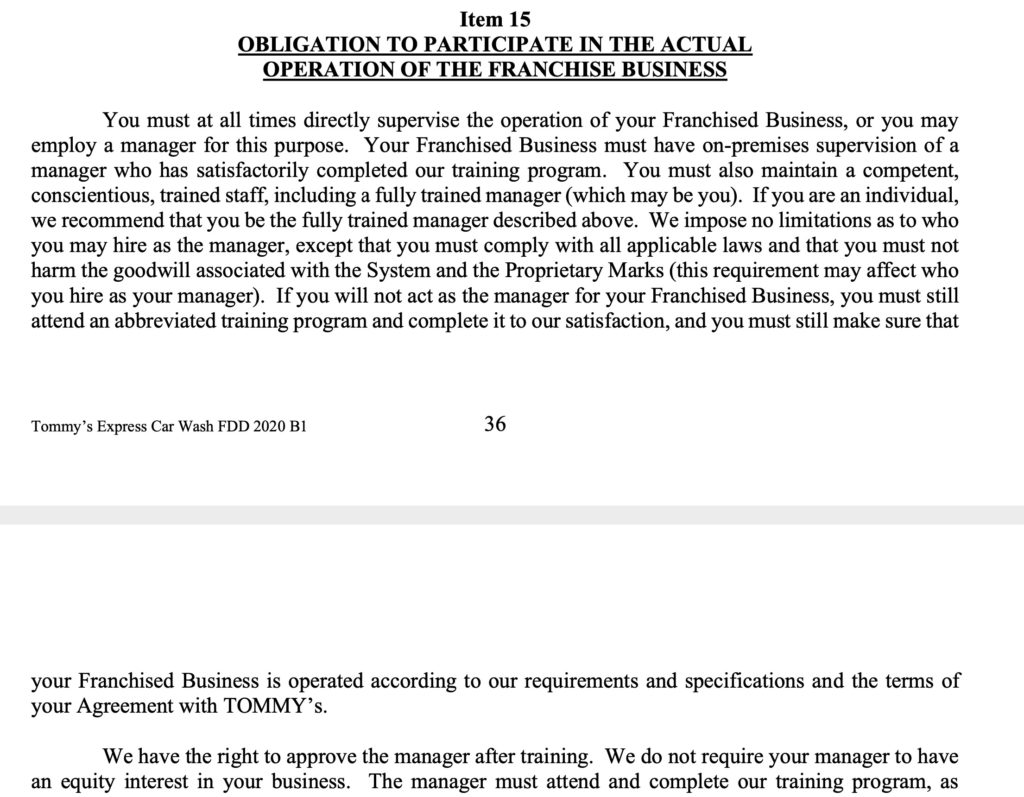

FDD Item 15: Obligation to Participate in the Actual Operation of the Franchise Business

The SBA has several guidelines which it requires lenders to follow when underwriting loans for businesses. One important guideline is verification of the involvement of the business owner(s) in the oversight of the business. SBA does not look favorably on absentee business owners who are simply investors in a business. A small silent partner investor with less than 20% ownership in the business is acceptable, but the majority owner should be involved in the daily operation of the business. The failure rate of a new business is higher when the owner is not present or when the there is too much dependence on hired help. Lenders will want to see a business plan and/or documentation of how the business owner will be a part of the daily operation of the business. What roles will the owner(s) play? What will each owner be responsible for? Who will manage what aspects of the oversight of sales, marketing, staffing, accounting, reporting and general supervision of the operation? Who will manage the managers? What hours will be devoted to the business on any given day, week or month?

Item 15 in the FDD outlines what the franchise expects of the owner with respect to his or her participation in the direct operation and supervision of the business. The franchise will frequently make certain training mandatory for the owner and managers. The manager and any subsequent manager must complete and pass the franchise training program, or be trained by the owner, before they can manage the franchise business. The owner and manager must demonstrate competence in several areas of running a franchise business, including some of the following: knowledge of basic policies and procedures, equipment assembly and use, customer service, equipment maintenance and sanitization, daily operations, record keeping, basic accounting techniques and ability to train employees.

If a lender sees something in this section that is not consistent with the SBA guidelines there will be a problem. When the SBA reviews a FDD, they will normally not approve the franchise if something is inconsistent with the basic guidelines they set. Alternatively, the SBA might only approve a certain version of the franchise agreement. Sometimes the SBA will make special notes on the approved list that warns lenders about certain parts of franchise agreements that would cause ineligibility. The “passive owner model” (or version) of the franchise agreement might not be eligible. The notes might say, “Only the unit franchise agreement is eligible”. It is best to verify what these notes say before making plans or applying for a loan.

Refer to the SBA Franchise Directory for notes

FDD Item 19: Financial Performance Representations

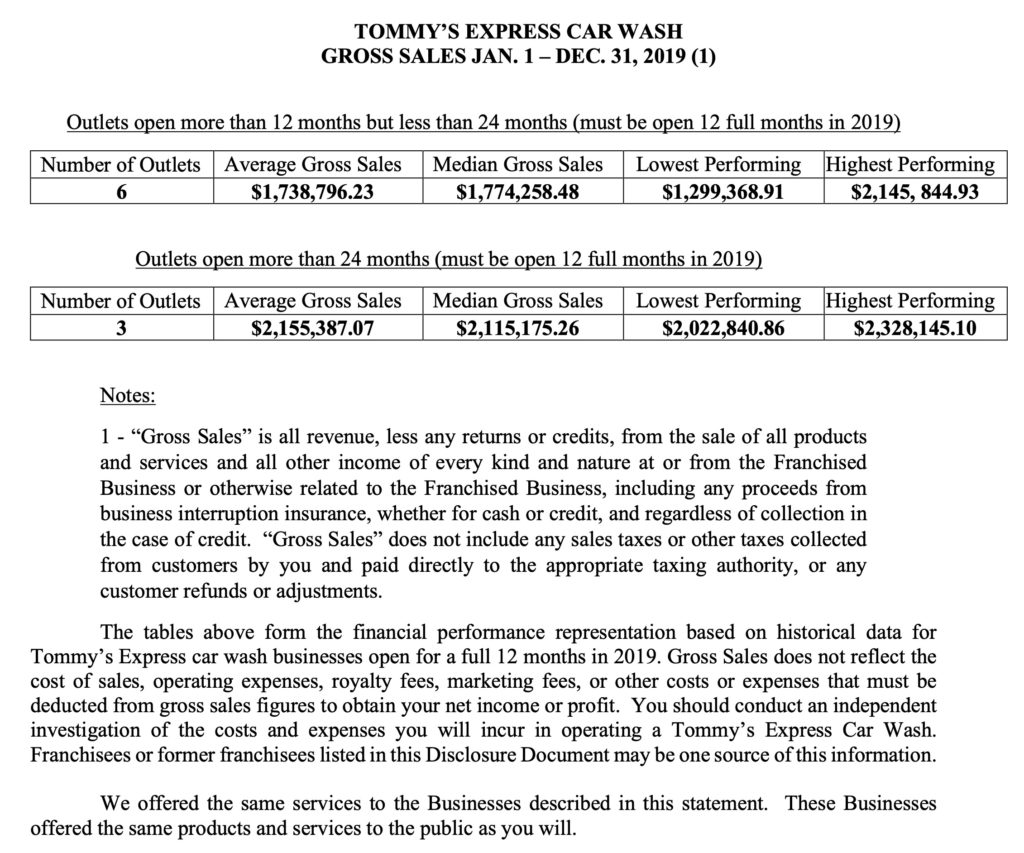

The Federal Trade Commission will allow a franchise to share actual or potential financial reports of its existing outlets or unit franchises if there is a basis for providing this information and if the information is included in the FDD. Many franchises provide charts with averages in Item 19. They will normally explain how many units the chart information represents and what calendar year the averages were taken from. Averages are often displayed monthly and annually.

Some of the numbers displayed might be: Total Revenue, Gross Profit, Gross Margin, Net Profit and Net Margin in a calendar year and/or monthly basis. The charts will display numbers from the lowest, highest and average or median of all franchisee units or outlets. The Item 19 may also explain definitions of what these terms refer to and how the numbers were figured.

When a business applies for an SBA loan, the lender will require financial projections in addition to the business plan. Financial projections are estimates of sales, cost of goods sold (COGS) and itemized expenses on a monthly basis. Some lenders want monthly projections for one year and a summary for the second and third year. Others might want two full years broken down on a monthly basis. Most lenders will have templates that a borrower can use. Some templates are simplistic and others are very complicated.

Borrowers should pay close attention to Item 19 of the FDD when putting together the financial projections for their application. Underwriters will be looking at the projections an applicant submits and comparing it to the Item 19 of the FDD. The numbers on the projections should be comparable to those on the charts in this section. If projected sales are lower than the low or higher than the high on the charts of Item 19, there will be cause for concern and questions to address. Applicants should also be prepared to answer what assumptions are being made when completing any particular line item for sales or for any of the expenses on the projection spreadsheet. How was the cost of insurance figured? What is the basis for the repair and maintenance category costs? Is the payroll part of the COGS or separated out from the COGS on the projections? Besides understanding Item 19 of the FDD, borrowers should be speaking to existing franchisees during the due diligence period and taking good notes on averages for revenues and expenses of those who they are interviewing.

Applicants commonly make the mistake of creating projections that are too conservative. Underwriters want to get a sense that the business owner has confidence in the sales numbers that will be obtained. Projecting sales numbers that are lower than the Item 19 low for the month or year will create cause for concern. It is understood that it takes a month or so for a business to open its doors and to ramp up. However, when projections show a loss month after month, with little growth and no profitability, there is not a good reason for underwriters to approve the loan. The projections will need to show that the business is “cash flowing” (showing profit once expenses are covered) after several months in business. In the same way, sales projections that are significantly higher than the best franchise unit in the system, would raise an eyebrow. This would indicate that the applicant has unreasonable expectations and possibly did not put enough thought into what would be possible. Either way, if the projections are too low or too high, applicants should be prepared to answer questions about the reason for the numbers they have submitted. The applicant should study the FDD Item 19 and investigate sales figures, costs and expenses with other franchisees and then create financial projections that fall within the averages from all of this research.

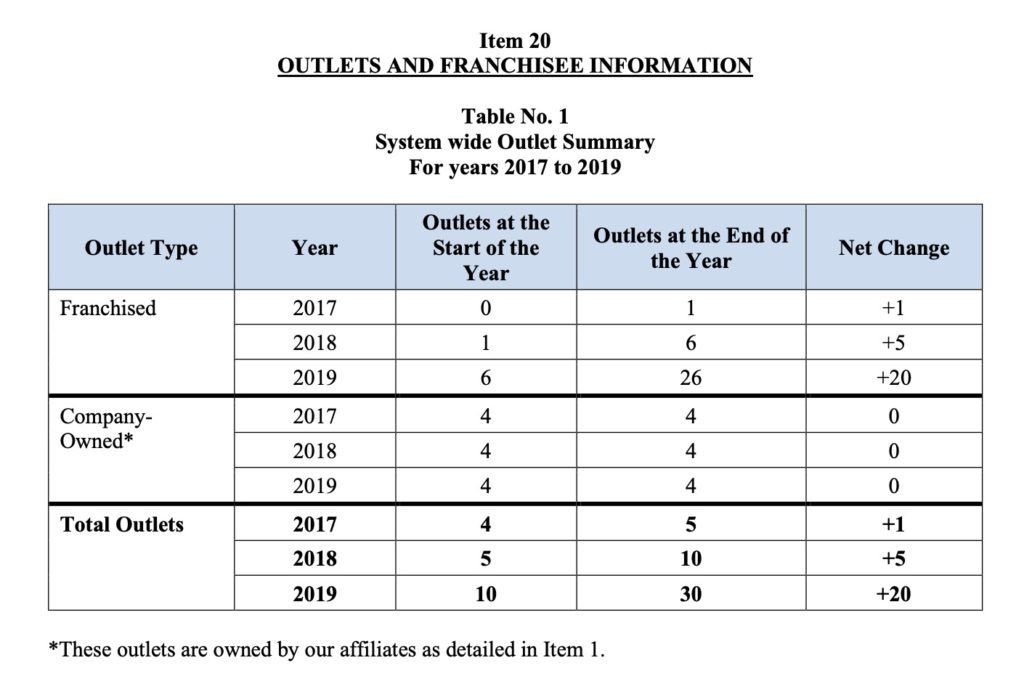

FDD Item 20: Outlets and Franchisee Information

In this section of the FDD the franchise discusses the number of outlets or units it has at the beginning of a calendar year and at the end of the calendar year and can also break it down by each particular State. Some have franchise owned units that are counted as well as the franchisee owned units. Most FDDs show these numbers in a chart over a 3 year period. If some failed, the numbers will show a decrease. Sometimes this is due to a transfer (acquisition of a unit or territory by a new owner, from a previous owner). Notes below the numbers usually explain the transfers that occurred.

Lenders pay close attention to this section because they want to see how many units have been added over time and how many have been lost (or have failed) over time. A large amount of franchise sales added in one year and then lost in the following year or two is an indication that there might be an internal problem or lack of support given to the franchisees by the franchisor. New franchises are particularly a bit risky because of the lack of historical financial data. Some lenders make a hard and fast rule that they will not consider a file unless the franchise shows that it has more than a certain number of units that the internal management decides is a safe bet.

The strength of a borrower’s file will also affect the whether or not a particular lender will consider financing the project. In some cases a few strong files will be allowed as a test by a lender to see how well they perform. Similar to an individual investor, lenders like to diversify their portfolio with different types of files from a variety of industries and different franchises. One particular lender may only want to finance a certain number of units of the same franchise, just in case something changes or unforeseen challenges arise. COVID-19 is a perfect example of an unforeseen challenge. Some franchises that were a huge success in the past are suffering terrible losses due to mandatory closures. Buffet style restaurants and spa services are two that have been negatively affected by the pandemic.

Summary

Key Commercial Capital’s representatives have a good understanding of the particulars that lenders look for in an application for business financing (both for franchise projects and non-franchised businesses). Our competent team is pleased to share knowledge and to assist borrowers in putting together well-prepared applications. Additionally, we spend a significant amount of time researching and talking to lenders to pre-clear particular franchises and/or certain industries. There are many lenders to consider and there may only be a few that are the right fit for a particular file. We help applicants save time by contacting only the lenders who we know will provide the best possible chance of an approval. We also help our clients to be prepared for the questions that will likely be asked by underwriters. It is particularly important for borrowers to share information about past credit issues or concerns upfront, so a strategy can be put into place before an application is submitted. It is better to plan ahead and to avoid mistakes that might cause an application to be declined. Once credit is pulled, all lenders will see the enquiry on the credit report. They will question the reason for the credit enquiry and ask why a new application is being submitted. A decline by one lender does not necessarily mean that every lender will decline the application, but it can raise some doubts and will certainly be the cause for further questions. It is a better process to have one of our representatives discusses the file with a lender to determine the possibility of obtaining an approval, before a credit enquiry is made. A new business owner is wise to obtain assistance from someone who has experience in navigating the road to acquiring the financing needed for his or her project.