Obtaining the right business financing can be difficult. The process can be confusing and sometimes damaging to your personal credit. Our knowledgeable staff offers the keys to accessing the funds your business needs to start-up, expand or move to the next level. We commit to working with you to open the right doors and will give you a variety of options to get the job done.

Key Commercial Capital works with franchises and start-up businesses in all 50 States of the USA. Pre-qualify to get started. We will follow up with you within 1 business day after receiving the report with your answers.

FRANCHISE FINANCING

ACQUISITION FINANCING

FRANCHISE EXPANSION FINANCING

Small Business Loan Consulting

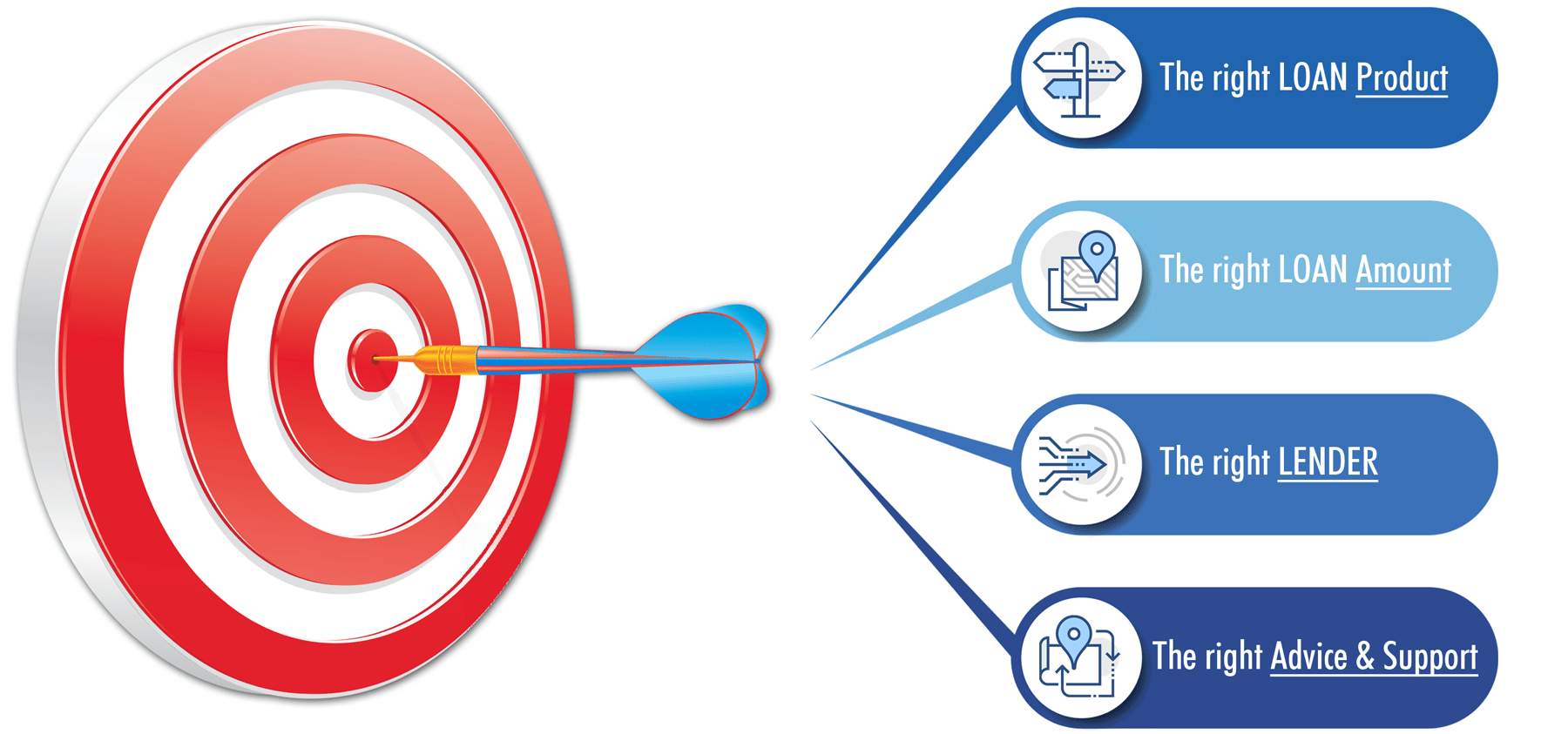

Key Commercial Capital specializes in Small Business Loan Consulting. We have knowledge about many programs that are available in each State and we work with small business owners to find the right program, the right loan amount and the right lender. We have a customized system for each borrower and can provide insight on the loan process for business start-ups, business expansions or business acquisitions. We are well-versed in SBA lending compliance at all stages of the loan process.