Franchise Financing

How is financing obtained for a new franchise territory?

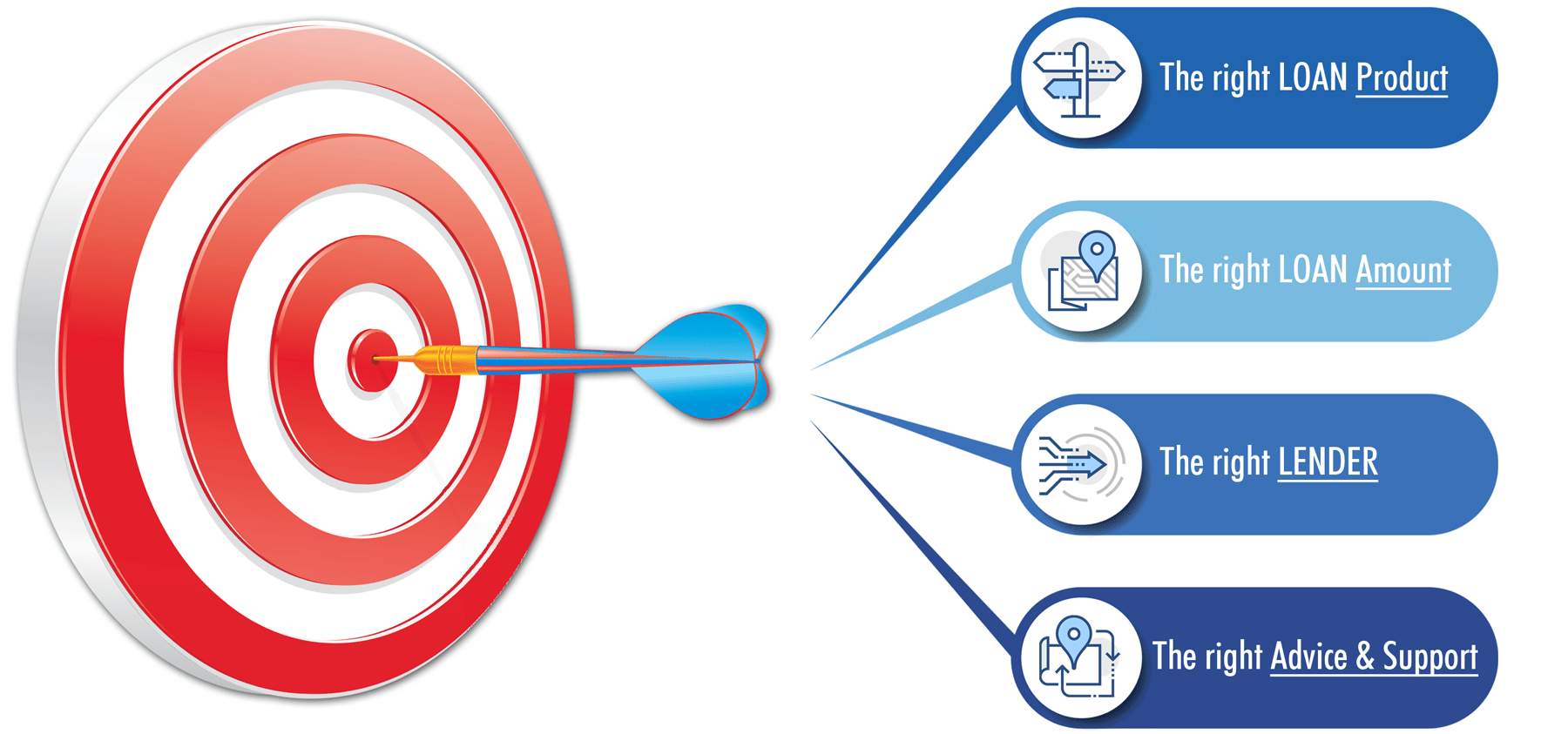

There is so much more to the story than going to a bank and submitting an application. Not all lenders work with start-up businesses. Even if the franchise is on the SBA approved list, not all lenders offer loans for every franchise concept. Some lenders will require a certain number of locations to have been open for at least a year. Others simply do not like to offer loans for certain industries. Most lenders require industry experience. We will evaluate your project, review the FDD from the franchise you are interested in and recommend the right lender fit for your file. We will also work with you through each step of the process to help you prepare an application that will have a greater chance of approval than you would have on your own. You do not have to guess which lender to contact or how to structure the application. We are here to help.

What if the franchise is not on the SBA approved list?

If the franchise is not on the approved list, we can either help the franchise understand what steps to take to get the FDD approved by the SBA. If the franchise is not able to be approved, we can help franchisees to finance the business through an Unsecured Loan, which is not regulated or guaranteed by the SBA. Some franchises are not eligible for SBA financing, due to being passive or not meeting other requirements. This is okay. We have other means of getting the job done. The Unsecured loan product does not require equity injection. The process does not evaluate a business plan, financial projections or review the franchise FDD or financial reports. In some cases, when the total project cost is lower, we suggest using the Unsecured Loan product even if the franchise is SBA approved. The process can be quicker and easier.

What changes if an ADA was signed (Area Development Agreement)?

Not all lenders like the ADA timeline deadlines. Some will be hesitant to offer financing on the first location if the deadline for opening second or third locations is too close to the projected opening for the first location. Some lenders will make exceptions, others will not. We do have lender partners that are willing to underwrite multiple locations at one time and to are willing stagger the closings. Every file is different and the details will determine the best route to get financing approved. We can help with planning and execution of the timelines and lenders who will be cooperative.

How much of a down-payment or equity injection will be expected?

Most lenders will require 10% to 20% of the project cost to be paid by the borrower. This will be determined by several factors in the file, the type of loan, loan amount and the lender. We will help borrowers to be prepared for what will be expected.

Can credit be received for funds already spent on the franchise?

If a borrower has paid the franchise fee and is seeking SBA financing, the franchise fee payment will be counted toward the total down-payment requirement. Any expense for legal, accounting, training, travel, equipment deposits, utility deposits, lease deposits, architect fees or general contractor deposits will also be counted. Keep in mind, equity credit will require the payments to be made from accounts that can provide verification of seasoned funds. This means, the payments must not be borrowed (put on credit card or line of credit). It does not mean that a borrower cannot use a credit card, it just means that if they want equity credit, they will need to show that the credit card was paid. Seasoned funds are funds in accounts for 2 to 3 months. It is a great idea to keep good records for all expenses (invoices, receipts, dates, accounts/cards used to pay). We will advise about how to track and present all of this documentation during the closing process.

Is it possible for family or friends to give a loan or gift toward the business toward the equity injection requirement for SBA financing?

A gift can be eligible toward equity injection of an SBA loan if it is from immediate family (father, mother, brother, sister, uncle, aunt, etc.) The funds must not be borrowed. The gift-giver will need to verify accounts with statements to show where the funds were derived from. There will also be a gift letter executed to evidence agreement that the funds are a gift, with no expectation of repayment. This does not mean that the gift-giver cannot be repaid. It simply means that there is an agreement and an understanding that the repayment is not required and hence subordinate to the SBA loan. If a friend would like to supply a gift, the friend would need to have some type of small ownership shares in the company. We can advise on this subject further. A small share of ownership would not require the individual to be a guarantor on the loan.

What is the process for SBA financing? What services does Key Commercial Capital offer at each stage?

PRE-QUALIFICATION ● APPLICATION COMPLETION & EVALUATION ● UNDERWRITING PREPARATION

- Determine which programs the business might be eligible for based on several factors (business credit, personal credit, revenue, outside income, liquidity, assets, liabilities, location, level of involvement, industry and type of project)

- Begin the pre-qualification process (answer the online questions here to get a jump start)

- Schedule a call with to have discussion about the programs and to answer questions

- Evaluate the costs of the project to determine the categories of loan proceeds (Lenders will require a properly prepared Project Cost Breakdown)

- Review the relevant parts of the FDD or Franchise Disclosure Document (if the business is a franchise) that Underwriters may be inspecting

- Compare your estimated project cost to the description of costs outlined in the FDD to ensure the costs are reasonably similar to what the franchisor has described

- Explain the process of obtaining architectural plans, equipment vendor quotes, GC bids and other details that will be needed for an accurate cost estimation that lenders will expect

- Research lenders and recommend a possible fit for the file after preliminary discussions

- Advise on the correct completion of SBA forms, bank application forms, personal and corporate tax returns and financial reports (if applicable) and all other requirements

- Assist in creation and/or revisions of financial projections and assumption descriptions

- Provide consultation on the business plan, suggestions for edits, additions, etc.

- Prepare you for underwriting questions or lender interviews

COMMITMENT LETTER REVIEW ● BORROWER/CONSTRUCTION CLOSING CHECKLIST EXPLANATION

- Review and explain all parts of the commitment letter from the lender upon approval

- Evaluate and advise about requirements for corporate documents, IRS Tax ID documents

- Corporation - Articles of Incorporation, Bylaws, DBA or fictitious name filing, EIN

- LLC – Articles of Organization, Operating Agreement, DBA or fictitious name filing, EIN

- Explain all aspects of borrower and construction closing checklist – what all parties must submit

- Borrower - Insurance policies, licensing documents, contracts, lease, invoices, franchise documents, equity injection documentation, zoning compliance, SBA forms, plans/specifications, NEHRP/ADA compliance forms, building and other permits

- General Contractor - Insurance policies, documents, contracts, lien-waiver forms, etc.

- Landlord - Subordination documents, lease details and renewal term requirements

- Franchise - Franchise agreement, SBA negotiated addendum form or SBA form 2462

- Preparation for initial closing, answer questions about process (whether attorney, mobile notary is being utilized or other details about how to be prepared for closing)

DISBURSEMENT ● POST CLOSING COMMUNICATION ● FINAL FUNDING ● FUTURE EXPANSION

Once the initial closing has occurred, if there is construction financing involved in the project, there will be several disbursements done over a period of time. We stay involved during this time period, as well as, during the closing process. Borrowers continue to have questions about many things that arise during a construction project. We want our clients to feel as though we are a resource they can depend on and an advocate who is working in their best interest, to get to the final finish line. We have a good relationship with our lender partner closers and fund disbursement team. This is not something that is common. Many firms consider their work to be completed, once an approval is obtained. We take our responsibilities much further. We are here for the borrower during the closing process and throughout the loan disbursement period.

We also provide advice on how to strategize for future business growth and expansion. Some of our clients have signed an ADA (Area Development Agreement) with their franchise. This means that they have the territory rights and the obligation to open multiple locations. Most franchises have a time frame that must be followed. In some circumstances we can finance more than one project at the same time, or we can help the borrower plan ahead for an easier application and approval process and stagger the projects appropriately. Having an understanding of what will be expected, ahead of time, will help business owners be properly prepared. Correct preparation will help minimize delays. It will also alleviate stress and save on unnecessary duplication of costs or costs that arise due to a lack of understanding or insightful planning.