Financing for Businesses in ALL 50 US States

What are the benefits of working with a business loan broker or business loan brokerage firm to find financing?

Brokers in any industry are able to offer their clients a variety of options. Because they have relationships or partnerships with several different contacts, they can find the best match for a particular scenario.

For example, if a small business owner decided to work with a print broker for a special print project it would be better than just going to one or two print suppliers. Print brokers would normally know the industry and the presses or print suppliers to get certain jobs done efficiently and economically. A print broker would know which partner to recommend for each product or special project that the client might need in order to save the business a significant amount of funds and time.

In the Insurance industry, working with an insurance broker, rather than a single insurance agent at a particular company would be beneficial. The insurance broker will likely provide options and insight about important factors related to different policies and providers. A knowledgeable insurance broker would be able to provide guidance in obtaining the best policy fit for a particular need and offer options with respect to pricing, deductibles, coverage and customer service.

Like Brokers in other industries, Business Loan Brokers can also offer a variety of options and insightful consultation.

Brokers Help Navigate

A business loan broker who has several partnerships with nationwide lenders and small community banks can help a client find the right fit for the financing needed by the business. Each bank or lender specializes in certain loan products they prefer to offer. Some banks do not cater to start-up businesses. They prefer to only work with businesses that have 2 or more years of tax returns and financials to evaluate. Some banks prefer to work with only particular franchises or certain industries. Some lenders are very strict on certain rules or regulations, where others might overlook certain things.

A business loan broker can help a client navigate through this maze to find the right lender fit for the particular financing project at hand. Brokers also help coach the business client about how to put together a clean application, with well organized documents, that meet the right requirements to get a more favorable response from underwriters. Good business loan brokers should know all of their different lender partner’s requirements and preferences and should offer valuable consultation.

Every State of the USA is served by Key Commercial Capital

Key Commercial Capital is not a direct lender. We are a business loan brokerage firm. We serve clients in every State in the USA. It is important that our business clients know that they can depend on us to find the right lender match for their particular file.

Some of our nationwide lender partners are in the top 25 of the SBA Lenders in the United States. We also have partnerships with small community lenders in several States. These partners may not be in the top 100 SBA lender list, but they still offer very good programs for certain projects. Many new business owners do not realize that it may not necessarily be a good idea to attempt a business loan application at the local bank on the corner of their neighborhood. The community bank can sometimes be a good choice for certain projects, but many times it is not the best choice. There are lenders in the SBA top 100 list who are strictly business banks. This means that they do not offer the consumer or residential products that a community bank offers. If your business is looking for an SBA loan, a business bank that deals in SBA loans ONLY can often be the best choice for a number of reasons.

Top 7 Reasons You Should Work with Business Banks when getting a Business Loan

Every State in the USA & Every Industry

Key Commercial Capital can work with business clients in every State of the USA and in almost every industry. We are also very well-versed in working with many franchises. We have helped some franchises who were not on the SBA approved Directory list to get in contact with the right person at the SBA to get their FDD (Franchise Disclosure Document) processed and approved quickly. We are open to working with new franchises and welcome questions. Sometimes certain lenders are leery of new franchise concepts even if the franchise has been approved and appears on the SBA Directory. We welcome new concepts and look forward to beginning new partnerships. We have the right lender partners who do not mind new franchise concepts.

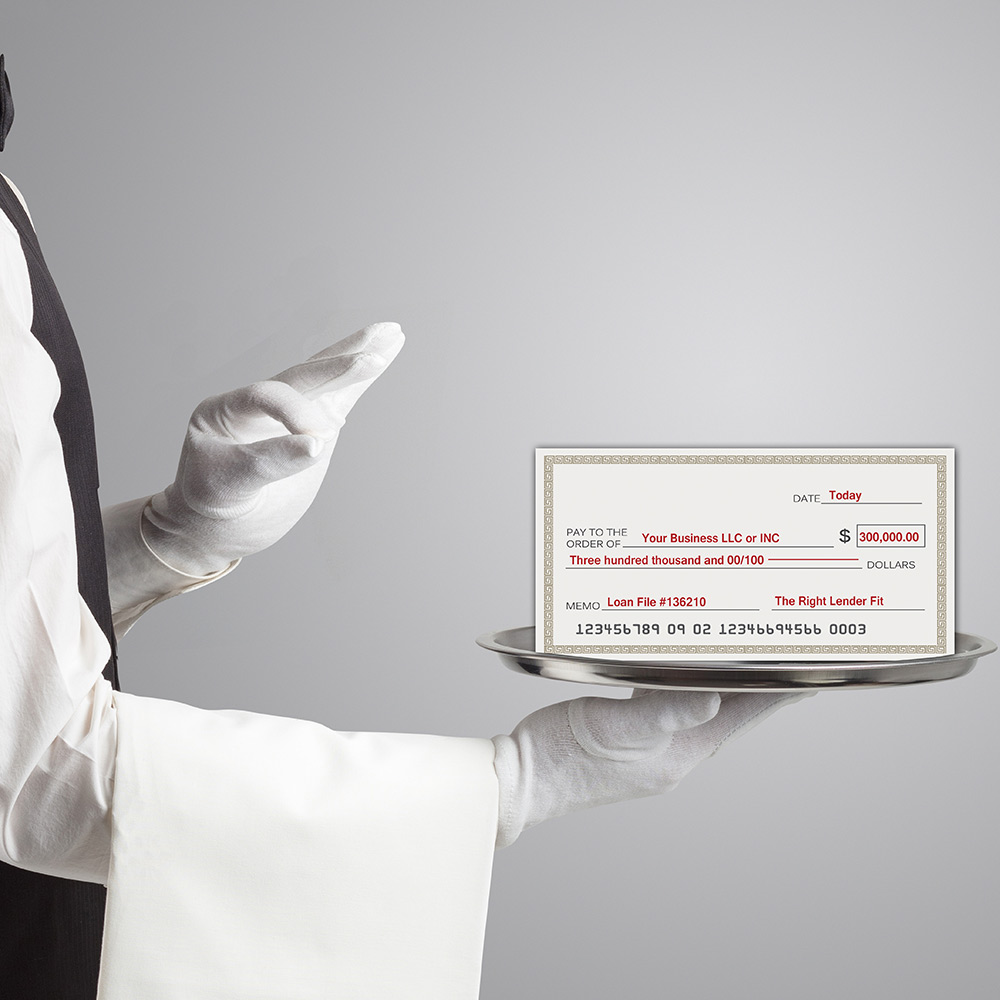

Creative Financing Options

Key Commercial Capital offers assistance with many different types of loans for businesses in addition to SBA loans. We have partnerships in place for merchant service loans, lines of credit, factoring transactions involving accounts receivable and other options that a single bank or lender might not offer. Sometimes we can help a sole proprietor get a personal loan that has no usage restrictions. In this way we can help an individual get started in business if he or she does not qualify for other business loan products. In summary, it is wise to work with a business loan broker in order to be given a number of options and to obtain guidance on which options are the right fit for a particular business financing project. We have listed a number of examples below in many States across the USA. Let us know how we can help you.

Examples of Business Deals our Team Financed Across the USA

In the State of Alabama we helped a Transportation Company obtain a line of credit for the business to help with cash flow.

In the State of Alabama we helped a husband and wife team obtain an SBA loan for their cookie franchise. The loan was able to cover their leasehold improvement, equipment, furniture, fixtures, inventory, training costs and working capital.

In the State of Alabama we helped a husband and wife team obtain an SBA loan for their coffee franchise. The loan was able to cover their leasehold improvement, equipment, furniture, fixtures, inventory, training costs and working capital.

In the State of Alabama we helped a client obtain an unsecured conventional loan and an equipment lease to open a 3D/4D Ultrasound practice.

In the State of Arizona we helped a young couple to obtain SBA financing to start up an in-home care franchise.

In the State of California we helped a client acquire an existing territory of a kitchen and bath franchise from sellers who were ready to retire. An SBA loan was used for the acquisition of the business and additional working capital for expanding the territory.

In the State of Colorado we helped a young lady obtain an SBA loan to start up a new territory of a specialty hair salon franchise.

In the State of Connecticut we helped a national convenience store franchise obtain an unsecured non-SBA loan.

In the State of Connecticut we helped a husband and wife team from a popular cookie franchise obtain an SBA loan for their leasehold improvement, equipment, furniture, fixtures, inventory, training costs and working capital.

In the State of Delaware we helped a national convenience store franchise obtain an unsecured non-SBA loan.

In the State of Florida we helped a nurse to start up her own assisted living facility. We helped the nurse obtain SBA financing for the commercial real estate space, equipment and working capital and rolled it all into one SBA loan.

In the State of Florida we helped an existing jewelry business obtain a conventional unsecured loan for expansion.

In the State of Florida we helped a husband and wife team and additional business partner pool together funds from Unsecured loans to obtain the full amount they required to fund their cookie franchise.

In the State of Georgia we helped a client obtain SBA financing for a medical and non-medical in-home care franchise start-up.

In the State of Georgia we helped an entrepreneur obtain an SBA loan for a semi tractor. His goal was to be the investor in the truck and to hire a driver with a CDL (Commercial Driver's License). He will work with a logistics company to help deliver for Amazon. As the owner of the business he will oversee the operation without being the driver. We were able to help him obtain an SBA loan for the truck. His closing process was quick and easy.

In the State of Hawaii we help a young couple overcome their rejection from a local lender and helped secure an SBA loan for them to start up an in-home senior care franchise location.

In the State of Idaho we helped a Trucking company obtain financing for new equipment

In the State of Illinois we helped a young entrepreneur to obtain an SBA loan to purchase a building and an existing auto-repair business.

In the State of Illinois we helped a husband and wife team from a popular cookie franchise obtain an SBA loan for their leasehold improvement, equipment, furniture, fixtures, inventory, training costs and working capital.

In the State of Illinois we helped an insurance agent/broker get an SBA loan to open his own agency.

In the State of Indiana we helped a young entrepreneur obtain SBA financing with the help of his family to start up a new territory for a locksmith franchise.

In the State of Indiana we helped an existing recycling company to get a line of credit to expand the business.

In the State of Iowa we helped a couple obtain SBA financing for the equipment to start a water vending business.

In the State of Iowa we helped a husband and wife team from a popular cookie franchise obtain an SBA loan for their leasehold improvement, equipment, furniture, fixtures, inventory, training costs and working capital.

In the State of Kentucky we helped an individual get start-up capital for a national convenience store franchise. The franchise is not on the SBA approved Directory so we were able to arrange an alternative type of financing for the business owner.

In the State of Kentucky we helped a group of individuals each obtain an Unsecured Loan to pool together the funds they needed for the franchise fee, equipment, leasehold improvement and working capital for a tea franchise.

In the State of Kentucky we helped an existing business obtain equipment financing for expansion.

In the State of Louisiana we helped a Physician obtain a conventional term loan

In the State of Maryland we helped an individual obtain SBA financing for the equipment to start a water vending business.

In the State of Massachusetts we helped an individual obtain a 401K ROBS in combination with an SBA loan to obtain financing for the equipment to start a water vending franchise.

In the State of Michigan we helped a couple get financing to start up a 3D/4D Ultrasound Studio franchise. The franchise was not listed on the SBA approved directory list so we were able to arrange alternative financing for the new business owners.

In the State of Michigan we helped a construction business to obtain several fix and flip loans. Entrepreneurs who look to obtain financing to fix up a home and sell it are not eligible for SBA financing, due to the rule of speculation. Since fixing and flipping homes is speculative it does not fall under the guidelines set forth by the SBA for financing. We were able to arrange alternative financing for our client.

In the State of Minnesota we helped a business owner obtain conventional financing for a commercial real estate loan on a small apartment building he wanted to purchase.

In the State of Missouri we helped a physician with an existing practice to obtain a conventional loan for working capital

In the State of Missouri we helped a husband and wife team from a popular cookie franchise obtain an SBA loan for their leasehold improvement, equipment, furniture, fixtures, inventory, training costs and working capital.

In the State of Montana we helped a restaurant obtain financing for new equipment

In the State of Montana we helped an individual get financing to start up a 3D/4D Ultrasound Studio franchise. The franchise was not listed on the SBA approved directory list so we were able to arrange alternative financing for the new business owner.

In the State of Nebraska we helped a young lady obtain an SBA loan to start up an in-home care franchise.

In the State of Nevada we helped two business partners start up their first automotive repair franchise location. An SBA loan was secured for the franchise, the leased space, build-out, equipment and working capital.

In the State of New Jersey we helped an esthetician obtain an SBA loan to start her own hair removal /waxing salon.

In the State of New Jersey we helped an Executive Recruiter obtain the working capital he needed to start his second company. He was turned down for a loan by a large well known bank. We were able to help him secure an SBA loan at an alternate bank. His process from approval to funding only took ONE week.

In the State of New York we helped a Finance Director who wanted to keep her current employment to get SBA financing for a new cost optimization consulting franchise.

In the State of North Carolina we helped an existing auto repair shop to get an SBA loan for working capital.

In the State of Ohio we helped an existing facilities management business obtain an SBA loan to expand to another territory across state lines.

In the State of Oklahoma we helped a group of 4 individuals from a popular cookie franchise obtain an SBA loan for their leasehold improvement, equipment, furniture, fixtures, inventory, training costs and working capital.

In the State of Oregon we helped a restaurant get financing for new equipment.

In the State of Oregon we helped a group of 4 individuals get SBA financing for a multiple location cookie franchise start-up.

In the State of Pennsylvania we were able to help a national convenience store franchisee to obtain a non-SBA loan for a convenience store and gas station combination. We helped with the financing for the land, building, build-out, inventory and working capital.

In the State of Pennsylvania we helped an individual get financing to start up a 3D/4D Ultrasound Studio franchise. The franchise was not listed on the SBA approved directory list so we were able to arrange alternative financing for the new business owner.

In the State of Rhode Island we helped a husband and wife team from a popular cookie franchise obtain an SBA loan for their leasehold improvement, equipment, furniture, fixtures, inventory, training costs and working capital.

In the State of South Carolina we helped a Jewelry Manufacturer obtain a line of credit to help with expansion

In the State of Tennessee we were able to help a couple open a 3D/4D Ultrasound Studio business by assisting with obtaining financing for the equipment that they needed to open their doors.

In the State of Texas we helped several different franchisees from a popular cookie franchise obtain SBA loans for their leasehold improvement, equipment, furniture, fixtures, inventory, training costs and working capital.

In the State of Texas we helped a husband and wife team get an SBA loan for their fitness franchise. The large loan was able to cover their leasehold improvement, equipment, furniture, fixtures, inventory, training costs and working capital.

In the State of Texas we helped an existing restoration and construction business to obtain a business line of credit and a conventional special construction loan product for home builders.

In the State of Texas we helped an existing software developer who created an online job board and networking platform to obtain working capital expansion funds through an SBA loan.

In the State of Utah we helped an existing bakery business to move into a new retail location. We arranged help for a 401K ROBS program and an SBA loan combination.

In the State of Virginia we helped a nurse to obtain an SBA loan to start up an in-home care nursing franchise.

In the State of Virginia we helped an entrepreneur obtain an SBA loan to purchase a tractor trailer to work in conjunction with a well known shipping company as an Independent contractor.

In the State of Washington we helped business clients obtain SBA financing to start-up a new irrigation and landscaping business.

In the State of Wisconsin we helped a farmer to obtain financing for new equipment.

In the State of Wisconsin we helped a buyer get an SBA acquisition loan to purchase a successful staffing franchise from the original owner

In the State of Wisconsin we helped a national convenience store franchisee to obtain start-up capital. The franchise was not listed on the SBA approved directory list so we were able to arrange alternative financing for the new business owner.